We Tell You What Malaysia Stocks To Buy – Backed by Proven AI Insights

Earn Extra Investment Earnings with 96% profitability accuracy

We Tell You What Stock To Buy Today

- 5 Malaysia Stock Picks Weekly with high-growth potential based on AI analytics

- Real-Time Alerts for KLSE/Stock Movements so you stay ahead of the market

- 1-on-1 Investment Consultation to build a custom portfolio for your goals

Learn how Malaysians are growing their stock profits using AI – See Mr. KEN's simple strategy

How Does It Work?

Discover How Mr. KEN Built His Wealth Through a Simple and Effective Investment Plan

Low Risk

Starting with an initial capital of RM 10,000, Mr. KEN wisely diversified into two different Malaysia stocks to reduce risk and enjoy stable returns.

Achieve Returns

Mr. KEN sold Malaysia stocks at the right time and kept high-potential counters for longer-term gains.

Compounding Wealth

Mr. KEN reinvested his profits into top-performing Malaysia stocks, taking full advantage of compounding returns – the “8th wonder of the world.”

Underperforming

He cut loss early on underperforming Malaysia counters and rotated funds into AI-picked stocks with strong growth.

Conclusion

By sticking to a disciplined plan, Mr. KEN achieved stable passive income from Malaysia stocks with help from AI.

Low Risk

Starting with an initial capital of RM 10,000, Mr. KEN wisely diversified into two different Malaysia stocks to reduce risk and enjoy stable returns.

Achieve Returns

Mr. KEN sold Malaysia stocks at the right time and kept high-potential counters for longer-term gains.

Compounding Wealth

Mr. KEN reinvested his profits into top-performing Malaysia stocks, taking full advantage of compounding returns – the “8th wonder of the world.”

Underperformance

He cut loss early on underperforming Malaysia counters and rotated funds into AI-picked stocks with strong growth.

Final Thoughts

By sticking to a disciplined plan, Mr. KEN achieved stable passive income from Malaysia stocks with help from AI.

Out of Our Last 30 Picks, 27 Have Achieved Significant Gains!

View the Successful Results of Our Recent Picks

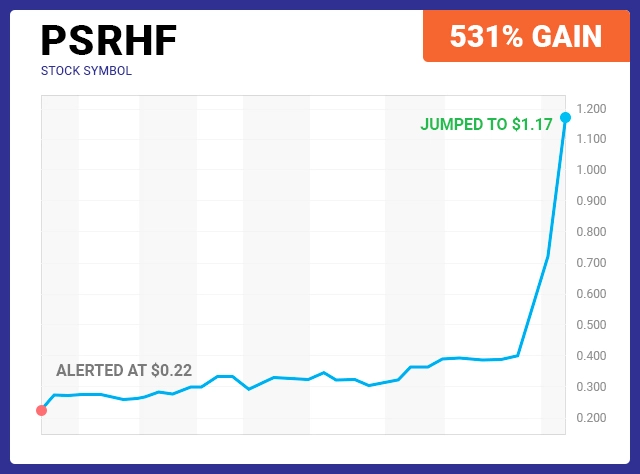

PSRHF

531% GAIN

ALERTED AT: $0.22| JUMPED TO: $1.17

NSTGQ

518% GAIN

ALERTED AT: $16.01 | JUMPED TO: $82.96

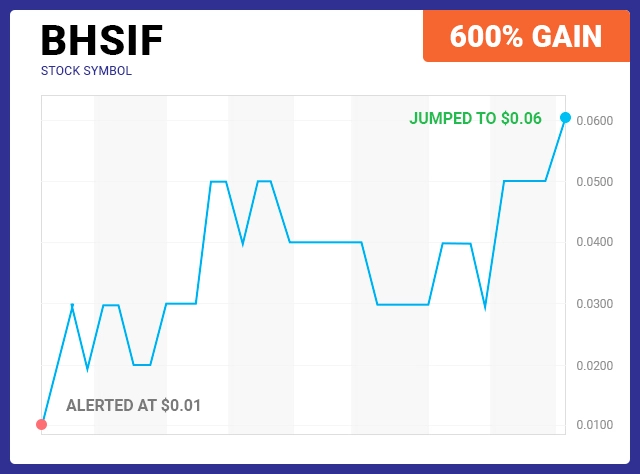

BHSIF

600% GAIN

ALERTED AT: $0.01 | JUMPED TO: $0.06

LBSR

2666% GAIN

ALERTED AT: $0.03 | JUMPED TO: $0.8

*Past performance is not a guarantee of future results. Investment returns and principal value can vary, meaning an investor’s shares may be worth more or less than their original cost upon redemption. Current performance may differ from the quoted performance, either lower or higher.

Begin in 3 Easy Steps

Register Your Interest Using the Form

Fill in the short form to get your free access to our beginner-friendly Malaysia Stock & AI Alert community.

Chat with Our Expert Team

Our local team will guide you step-by-step on how to pick stocks, use our AI tools, and grow your returns.

Earn Per Day, Available Anytime, Anywhere

Start small, learn fast. Get daily stock picks and insights to earn anytime, anywhere – even from your phone.

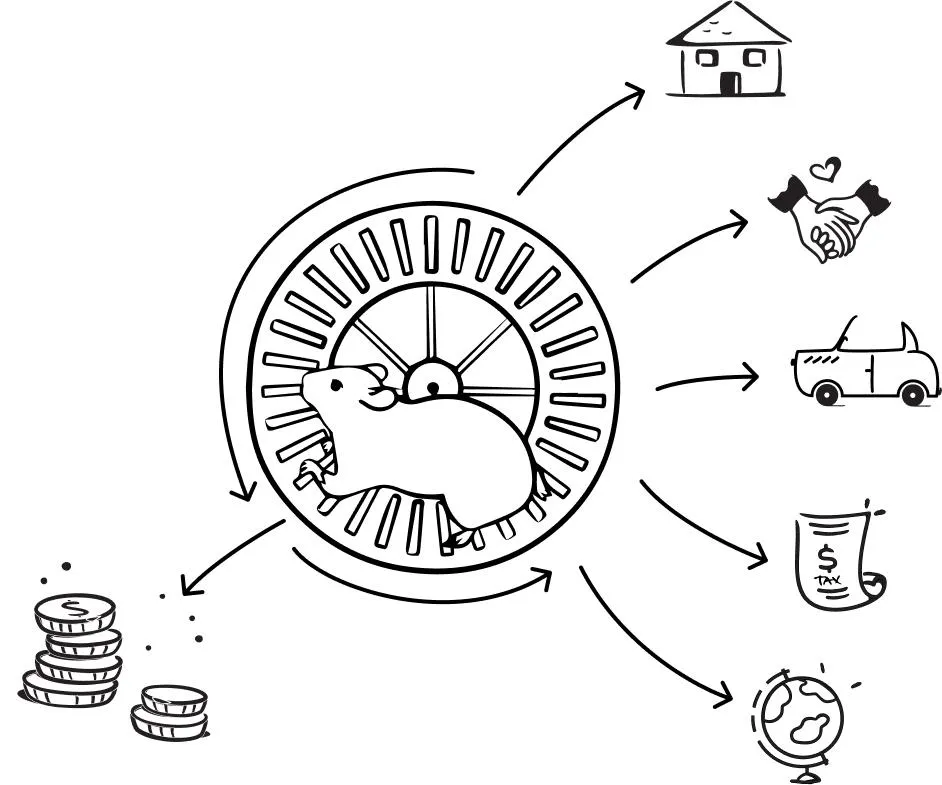

It's Time to Stop Living for Retirement

Many people believe that to retire (or stop working), they must save a substantial amount of money to sustain themselves for the remainder of their lives.

However, retirement is not solely about the size of your savings but rather the amount of income that your savings can generate each year.

The misconception that the quality of retirement depends on how much money you can save is referred to as the Accumulation Fallacy™.

The Accumulation Fallacy™ suggests that by amassing a significant amount of money, one can cease working and rely on that wealth.

But the reality is…

- We don't have clarity on how substantial this sum needs to be.

- We are unaware of how long it must last.

- We also cannot foresee the risks that could diminish it... including taxes, market collapses, or health problems as we age.

It is the one concept that prevents many of us from breaking free from the cycle of endless work… Spending our lives toiling away… Attempting to save money for the future… While also struggling to cover our other expenses with our constrained incomes.

In reality, our capacity to retire or leave our jobs is less about the size of our savings and more about how much income that savings can generate annually.

In simple terms, to stop working, you need to substitute the income from your job with earnings from your investments.

Whether this income comes from dividends, rental income, or capital appreciation, all of these are considered the return on your investments.

Due to the lack of financial education in our schools, we have been conditioned to believe that a 7 to 10% growth is a satisfactory return on investment.

However, as previously demonstrated, a 7 to 10% return leaves little after accounting for taxes, inflation, and fees.

If we aim to retire with an annual income of RM100,000, we would require RM1,000,000 to achieve that at a 10% return.

As you can see, accumulating that amount on an average salary is quite challenging. However, if we can achieve a 20% return, the amount needed to generate RM100,000 per year drops to RM500,000.

Are You Ready to Find Out If This Is Right for You?

To proceed, please fill out the expression of interest form attached to the button below. Once submitted, our specialists will reach out to schedule a time to connect and evaluate if this is a good match for you.

We Show You How to Manage Your Own Returns.

Controlling your returns is the core skill for creating wealth… In other words, it’s your ability to build and increase your financial resources.

People interested in trading often ask us, ‘What returns can I expect to see?’

Our answer is… When you have a solid understanding of trading fundamentals, you can dictate the returns you wish to achieve.

We realize this concept might be difficult for some to grasp, but if you aim for a 20% annual return, you can achieve it.

You Control Your Own Outcomes

If you’re aiming for returns of 30%, 50%, or even 100%, it’s entirely possible.

One of the major issues stemming from the inadequate financial education we’ve received is that many individuals believe these returns are unrealistic or, at best, extremely risky.

Nevertheless, our students are developing trading strategies designed to achieve the returns or growth they seek.

They possess the skills to backtest their plans and demonstrate that they can attain the growth they desire.

They are executing these strategies to reach the growth they seek, all while effectively managing their risks.

They control the risk associated with each trade.

They have identified and evaluated the stocks that can deliver the growth they want and have decided how much they are prepared to risk if the trade turns unfavorable.

There is no other educational program that gives you the ability to oversee your returns.

Hear From Small Cap Stock Traders Who Have Made a Fortune

Over the years, smart penny stock investing has made many people millionaires.

David Hart

Kuala Lumpur, MY

“I followed one of the stock picks recommended by your AI tool and made RM2,000 in just a few days. Honestly, I didn’t expect it to be this accurate. Now I always check your alerts before making any moves.”

Harold Court

Kuala Lumpur, MY

“I was completely new to stock investing, but your team explained everything clearly and patiently. I’ve already seen my portfolio grow. Thanks for making investing simple and profitable for people like me!”

Callum Reynolds

Johor Bahru, MY

“As a retiree, I was just looking for safe, consistent returns. Your AI suggestions helped me pick stocks that steadily grow. I’ve made over RM3,500 so far — very happy with the results.”

Eugene Smith

Penang, MY

“Didn’t think investing could be this flexible. I manage my portfolio on my phone, and I’ve already made daily returns from stocks I wouldn’t have found myself. Appreciate the guidance!”

Investment Strategy

These simple and clear insights on diverse topics have transformed the Investment Strategy for numerous individuals.

Technical Analysis: Gann Theory

- Price and Time Symmetry: Gann Theory emphasizes the relationship between price and time to forecast potential market reversals and trend continuations, using geometric angles to identify key support and resistance levels.

- Strategic Entry and Exit: The use of Gann angles allows traders to strategically determine optimal buy and sell points, setting clear stop-loss (S/L) and take-profit (T/P) levels for better risk management.

- Long-Term Market Insights: By analyzing historical price patterns and time cycles, Gann Theory helps in predicting long-term market movements, although it requires significant expertise for accurate implementation.

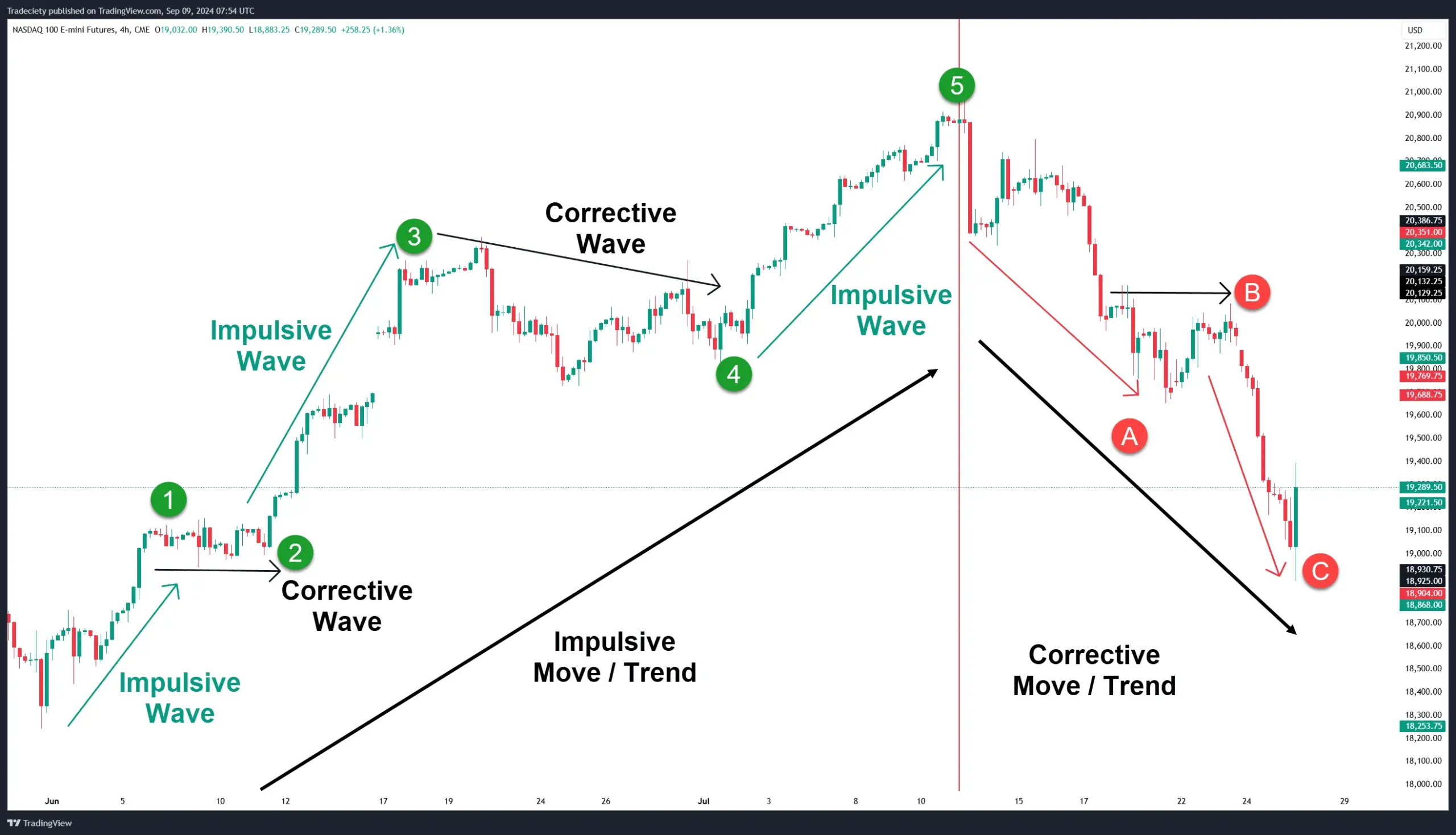

Technical Analysis: Elliott Wave Theory

- Understanding Market Psychology: Elliott Wave Theory breaks down market movements into impulsive and corrective waves, revealing the underlying crowd psychology driving price trends. This helps traders anticipate future price action with greater confidence.

- Identifying Trend Patterns: By analyzing wave structures (1-2-3-4-5 for trends and A-B-C for corrections), investors can identify key market phases and determine whether the market is in a bullish or bearish cycle. This method provides clarity in complex market movements.

- Strategic Investment Decisions: Use wave analysis to position investments during trend reversals and capitalize on opportunities while minimizing risks.

Technical Analysis: Market Profile Analysis

- Visualizing Market Dynamics: Market Profile Analysis maps out price and volume distribution to identify key value areas, providing clarity on market behavior and trends.

- Strategic Trading Opportunities: By analyzing areas of high and low volume (POC and distribution zones), traders can spot potential breakout or reversal points, helping refine entry and exit strategies.

- Adapting to Market Changes: This tool enables traders to align their strategies with evolving market trends, ensuring they stay ahead in an ever-changing trading environment.

Discounted Cash Flow (DCF) Analysis

- Evaluating Financial Health: DCF analysis focuses on estimating a company’s future cash flows and discounting them to their present value, providing a clear picture of its intrinsic value.

- Key Insights for Investment Decisions: By analyzing critical factors like revenue growth, operating margins, and capital expenditures, DCF helps investors identify undervalued or overvalued opportunities.

- Informed Long-Term Strategy: This method empowers investors to make data-driven decisions by assessing a company’s financial stability, growth potential, and risk factors for sustainable returns.

Economic Moat Analysis

- Defining Competitive Advantage: Economic moat analysis identifies a company’s long-term competitive edge, such as brand loyalty, cost advantages, or network effects, that helps it maintain profitability and outlast competitors.

- Navigating Regulatory Impacts: Changes in regulations, tax policies, or government interventions can affect market dynamics. Understanding these shifts helps investors evaluate a company's resilience and growth potential.

- Enhancing Investment Decisions: By assessing a company’s ability to sustain its moat amidst external changes, investors gain deeper insights into risks and opportunities, enabling informed and strategic long-term investments.

Common Questions and Their Answers

Our stock picks are designed to help everyday Malaysians discover high-potential investments using AI-backed analysis, with the goal of maximizing profits and reducing guesswork.

Our AI combines technical indicators, fundamental analysis, and local market trends (including Bursa Malaysia) to generate smart, data-driven stock insights—reviewed by our expert analysts.

Absolutely. We clearly label each stock suggestion based on its ideal time frame—whether it’s a short-term swing trade or a long-term growth stock.

Our AI model has consistently identified stocks with strong upward potential. Combined with human vetting, we aim for over 90% signal accuracy based on past performance.

You can speak directly with our local investment team. We’ll help you choose strategies based on your income, goals, and risk level—whether you’re a beginner or experienced investor.

Safeguard Your Future

We are so sure that you can at least 10X your investment in this course that we allow you a complete 30 days to share that belief..

Should you find that, within 30 days of starting the course, you don’t think you can achieve a 10X return, we will offer you a full refund—no questions necessary.

ABOUT US

Mycapitaltgrow is committed to helping Malaysians grow their wealth through reliable stock insights and smart investment planning.

We deliver clear, data-driven research to support better financial decisions—backed by AI and expert analysis.

Contact Us

- Kuala Lumpur, Wilayah Persekutuan Kuala Lumpur

- info@mycapitaltgrow.online

- (11:00 AM to 07:00 PM Except Sunday)

- +03-27792369